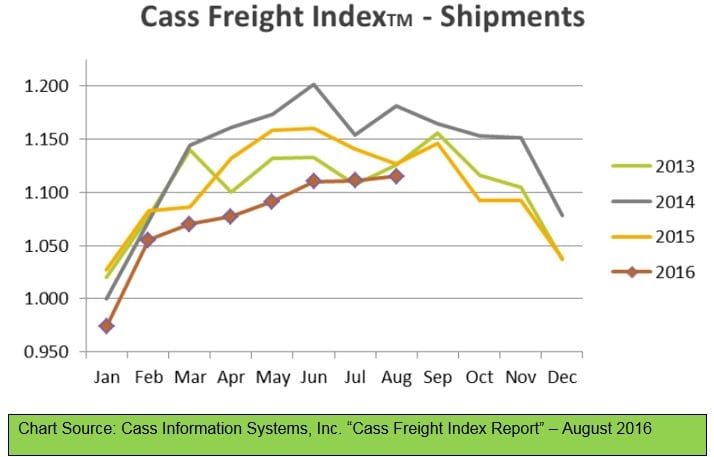

August’s Cass Freight Index continued to signal that overall shipment volumes (and pricing) are persistently weak, with increased levels of volatility as all levels of the supply chain (manufacturing, wholesale, retail) continue to try and work down inventory levels. That said, there have been a few areas of growth, mostly related to e-commerce, with lower levels of expansion being experienced in transit modes serving the auto and housing/construction industries. All of this added up to slightly lower shipment volumes in August on a YoY (year-over-year) basis, marking the eighteenth straight month of year-over-year decline. That said, at least on a seasonally adjusted basis, August volume was up sequentially, offering a glimmer of hope that the contraction in volumes may be getting closer to an end.

Unfortunately, the glimmer of potential reason for hope provided by the Shipments Index was not echoed by the Expenditures Index. Total expenditures were down 3.3% sequentially, and the YoY rate of contraction reaccelerated to down 6.3% (after appearing to ease a bit in July, which was only down 5.1%).

SHIPMENT VOLUMES

What specifically drove August volumes? It wasn’t rail volume. The Association of American Railroads (AAR) reported that August YoY overall traffic for U.S. Class 1 railroads declined, as intermodal units fell 5.3% and commodity carloads originated fell 6.7%. Rails have seen persistent weakness, with overall volumes being negative 82 out of the last 83 weeks.

We continue to assert the trucking industry provides one of the more reliable reads on the pulse of the domestic economy, as it gives us clues about the health of both the manufacturing and retail sectors. We should note that as the first industrial-led recovery (2009-2014) since 1961 came to an end, and the shift from ‘brick and mortar’ retailing to e-commerce/omni-channel continues, we are becoming more focused on the number of loads moved by truck and less focused on the number of tons moved by truck. Tonnage itself appears to be growing (three-month moving average +2.59% not seasonally adjusted, +2.74% seasonally adjusted). Counter to this, truck loads have now contracted on a YOY basis four out of the last six months, with July’s -3.46% bringing the three-month moving average on total loads down to -1.59%. No matter how it is measured, the data coming out of the trucking industry has been both volatile and uninspiring.

>> Click here to access the entire report from Cass Information Systems.