Source: Institute for Supply Management – August 6, 2020

Economic activity in the manufacturing sector grew in July, with the overall economy notching a third consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

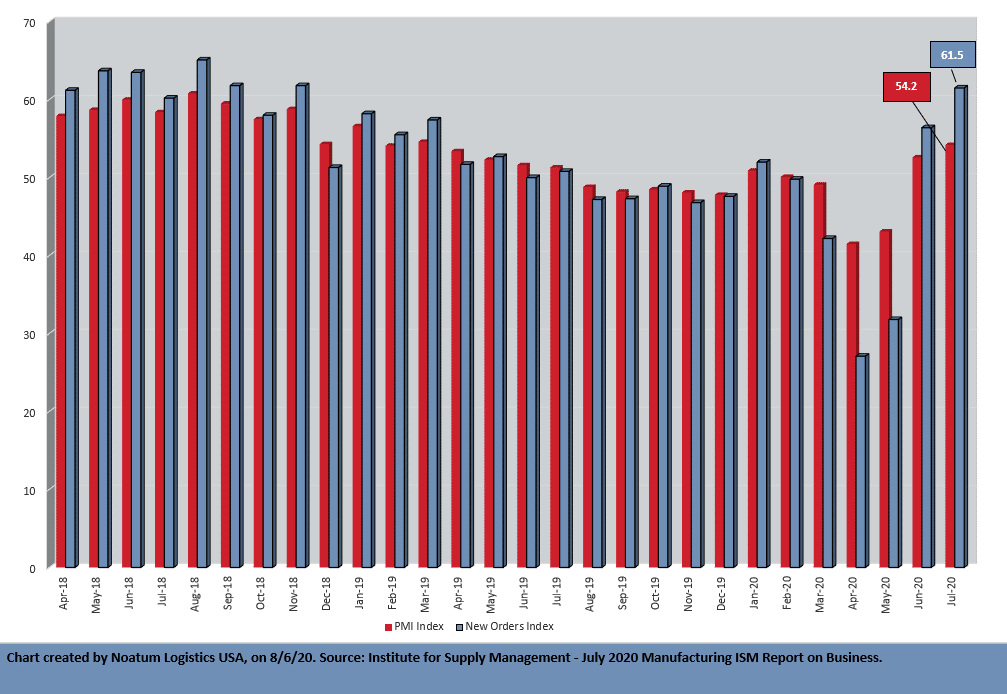

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The July PMI® registered 54.2 percent, up 1.6 percentage points from the June reading of 52.6 percent. This figure indicates expansion in the overall economy for the third month in a row after a contraction in April, which ended a period of 131 consecutive months of growth. The New Orders Index registered 61.5 percent, an increase of 5.1 percentage points from the June reading of 56.4 percent. The Production Index registered 62.1 percent, up 4.8 percentage points compared to the June reading of 57.3 percent. The Backlog of Orders Index registered 51.8 percent, an increase of 6.5 percentage points compared to the June reading of 45.3 percent. The Employment Index registered 44.3 percent, an increase of 2.2 percentage points from the June reading of 42.1 percent. The Supplier Deliveries Index registered 55.8 percent, down 1.1 percentage points from the June figure of 56.9 percent.

“The Inventories Index registered 47 percent, 3.5 percentage points lower than the June reading of 50.5 percent. The Prices Index registered 53.2 percent, up 1.9 percentage points compared to the June reading of 51.3 percent. The New Export Orders Index registered 50.4 percent, an increase of 2.8 percentage points compared to the June reading of 47.6 percent. The Imports Index registered 53.1 percent, a 4.3-percentage point increase from the June reading of 48.8 percent.

“In July, manufacturing continued its recovery after the disruption caused by the coronavirus (COVID-19) pandemic. Panel sentiment was generally optimistic (two positive comments for every one cautious comment), continuing a trend from June. Demand expanded, with the (1) New Orders Index growing at a strong level, supported by the New Export Orders Index re-entering expansion; (2) Customers’ Inventories Index remaining at a level considered a positive for future production, and (3) Backlog of Orders Index returning to expansion for the first time in five months. Consumption (measured by the Production and Employment indexes) contributed positively (a combined 7-percentage point increase) to the PMI® calculation, with industries continuing to expand output after May’s return-to-work actions.

Inputs — expressed as supplier deliveries, inventories and imports — weakened for the third straight month, due to supplier delivery issues abating and import levels re-entering expansion. Inventory levels contracted due to strong production output, supplier delivery difficulties and inventory minimization. Inputs contributed negatively (a combined 4.6-percentage point decrease) to the PMI® calculation but were more than offset by the demand and consumption improvement, as was the case in June. (The Supplier Deliveries and Inventories indexes directly factor into the PMI®; the Imports Index does not.) Prices remained in expansion, supporting a positive outlook.

“The growth cycle continues for the second straight month after three prior months of COVID-19 disruptions. Demand and consumption continued to drive expansion growth, with inputs remaining at parity with supply and demand. Among the six biggest industry sectors, Food, Beverage & Tobacco Products remains the best-performing industry sector, with Chemical Products, Computer & Electronic Products and Petroleum & Coal Products growing respectably. Transportation Equipment and Fabricated Metal Products continue to contract, but at soft levels,” says Fiore.

Of the 18 manufacturing industries, 13 reported growth in July, in the following order: Wood Products; Furniture & Related Products; Textile Mills; Printing & Related Support Activities; Food, Beverage & Tobacco Products; Plastics & Rubber Products; Chemical Products; Apparel, Leather & Allied Products; Computer & Electronic Products; Primary Metals; Petroleum & Coal Products; Miscellaneous Manufacturing; and Electrical Equipment, Appliances & Components. The three industries reporting contraction in July are: Transportation Equipment; Machinery; and Fabricated Metal Products.

Click here to access the entire release from the Institute for Supply Management website.