Source: Institute for Supply Management April 1 2019

Economic activity in the manufacturing sector expanded in March, and the overall economy grew for the 119th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

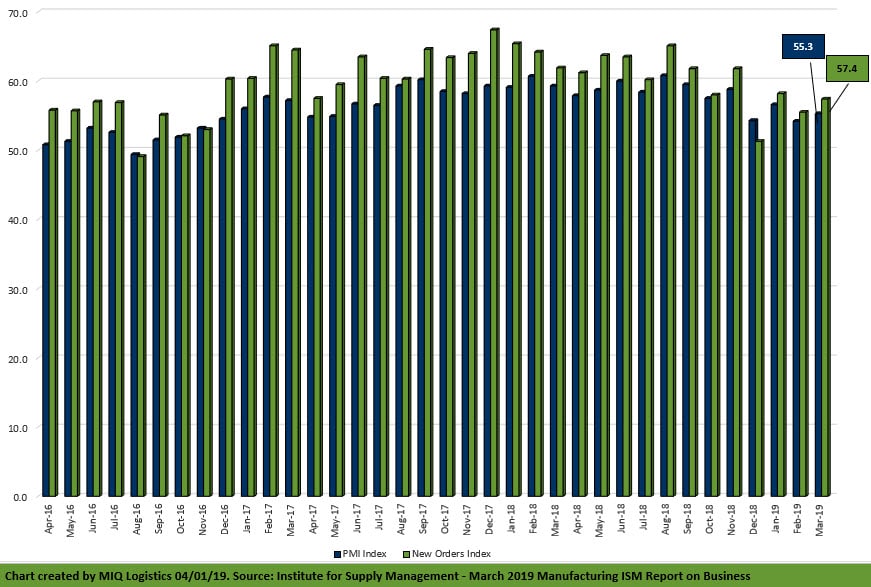

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The March PMI® registered 55.3 percent, an increase of 1.1 percentage points from the February reading of 54.2 percent. The New Orders Index registered 57.4 percent, an increase of 1.9 percentage points from the February reading of 55.5 percent. The Production Index registered 55.8 percent, a 1-percentage point increase compared to the February reading of 54.8 percent. The Employment Index registered 57.5 percent, an increase of 5.2 percentage points from the February reading of 52.3 percent. The Supplier Deliveries Index registered 54.2 percent, a 0.7 percentage point decrease from the February reading of 54.9 percent. The Inventories Index registered 51.8 percent, a decrease of 1.6 percentage points from the February reading of 53.4 percent. The Prices Index registered 54.3 percent, a 4.9-percentage point increase from the February reading of 49.4 percent, indicating a return of increasing raw materials prices after a two-month respite.

“Comments from the panel reflect continued expanding business strength, supported by gains in new orders and employment. Demand expansion continued, with the New Orders Index returning to the high 50s, the Customers’ Inventories Index improving but remaining too low, and the Backlog of Orders Index softening to marginal expansion levels. Consumption (production and employment) continued to expand and regained its footing with a combined 6.2-percentage point gain from the previous month’s levels, recovering most of February’s loss. Inputs — expressed as supplier deliveries, inventories and imports — were lower this month, primarily due to inventory consumption exceeding inputs, resulting in a combined 2.3-point decline in the Supplier Deliveries and Inventories indexes that contributed negatively to the PMI®. Imports expansion declined to near-zero expansion levels. Overall, inputs continue to reflect an easing business environment, but to a lesser extent than in February, confirmed by the Prices Index returning to expansion.

“Exports orders continue to expand, but at marginal levels. Prices reversed two months of contraction by returning to a robust mid-50s level. The manufacturing sector continues to expand, demonstrated by improvements in the PMI® three-month rolling average, which is consistent with overall manufacturing growth projections,” says Fiore.

Of the 18 manufacturing industries, 16 reported growth in March, in the following order: Printing and Related Support Activities; Textile Mills; Food, Beverage and Tobacco Products; Petroleum and Coal Products; Computer and Electronic Products; Electrical Equipment, Appliances and Components; Furniture and Related Products; Chemical Products; Plastics and Rubber Products; Wood Products; Nonmetallic Mineral Products; Transportation Equipment; Miscellaneous Manufacturing; Fabricated Metal Products; Primary Metals; and Machinery. The two industries reporting contraction in March are: Apparel, Leather and Allied Products; and Paper Products.

Click here to access the entire release from the Institute for Supply Management website.