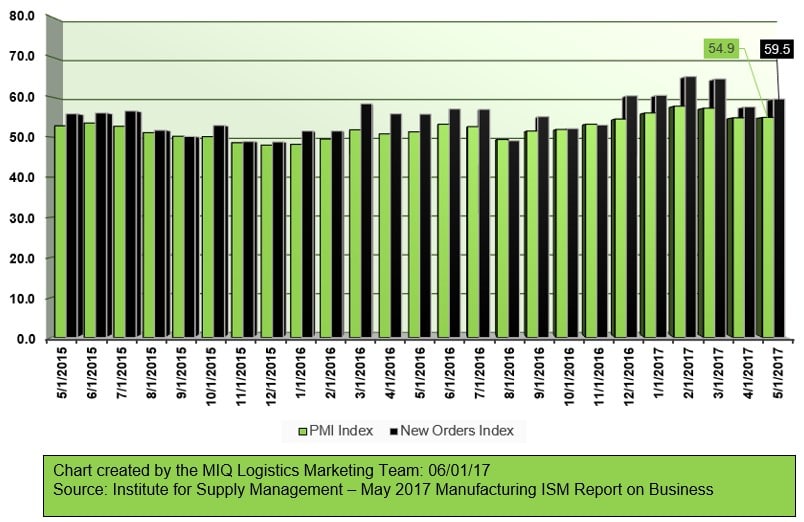

Source: Institute for Supply Management

Economic activity in the manufacturing sector expanded in May, and the overall economy grew for the 96th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The May PMI® registered 54.9 percent, an increase of 0.1 percentage point from the April reading of 54.8 percent. The New Orders Index registered 59.5 percent, an increase of 2 percentage points from the April reading of 57.5 percent. The Production Index registered 57.1 percent, a 1.5 percentage points decrease compared to the April reading of 58.6 percent. The Employment Index registered 53.5 percent, an increase of 1.5 percentage points from the April reading of 52 percent. The Inventories Index registered 51.5 percent, an increase of 0.5 percentage point from the April reading of 51 percent. The Prices Index registered 60.5 percent in May, a decrease of 8 percentage points from the April reading of 68.5 percent, indicating higher raw materials prices for the 15th consecutive month, but at a noticeably slower rate of increase in May compared with April. Comments from the panel generally reflect stable to growing business conditions, with new orders, employment and inventories of raw materials all growing in May compared to April. The slowing of pricing pressure, especially in basic commodities, should have a positive impact on margins and buying policies as this moderation moves up the value chain.”

Of the 18 manufacturing industries, 15 reported growth in May in the following order: Nonmetallic Mineral Products; Furniture & Related Products; Plastics & Rubber Products; Machinery; Primary Metals; Food, Beverage & Tobacco Products; Electrical Equipment, Appliances & Components; Paper Products; Miscellaneous Manufacturing; Computer & Electronic Products; Transportation Equipment; Chemical Products; Fabricated Metal Products; Petroleum & Coal Products; and Printing & Related Support Activities. Two industries reported contraction in May compared to April: Apparel, Leather & Allied Products; and Textile Mills.

WHAT RESPONDENTS ARE SAYING …

- “Sales have picked up compared to the last two months. Customer demand has increased.” (Plastics & Rubber Products)

- “Economy is still strong, but [the] political climate can change things very quickly.” (Transportation Equipment)

- “Global price increases for commodities.” (Electrical Equipment, Appliances & Components)

- “Business (sales/production) is steady. Pricing pressures on raw materials. Skilled labor in short supply.” (Furniture & Related Products)

- “Agricultural demand very strong.” (Chemical Products)

- “Our business is definitely paying attention to developments with the Canadian lumber tariff announcement. The final outcome could change our fiber pricing.” (Paper Products)

- “OEM longer lead parts possibly longer lead time due to more orders.” (Nonmetallic Mineral Products)

- “Business conditions are steady, and with competition increasing, it’s making negotiations even more intense to reduce costs.” (Machinery)

- “Business is booming, and getting direct employees is increasingly difficult.” (Fabricated Metal Products)

- “Difficult to find qualified labor for factory positions.” (Food, Beverage & Tobacco Products)

>> Click here to access the entire release from the Institute for Supply Management.