Institute for Supply Management

Economic activity in the manufacturing sector expanded in November, and the overall economy grew for the 90th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

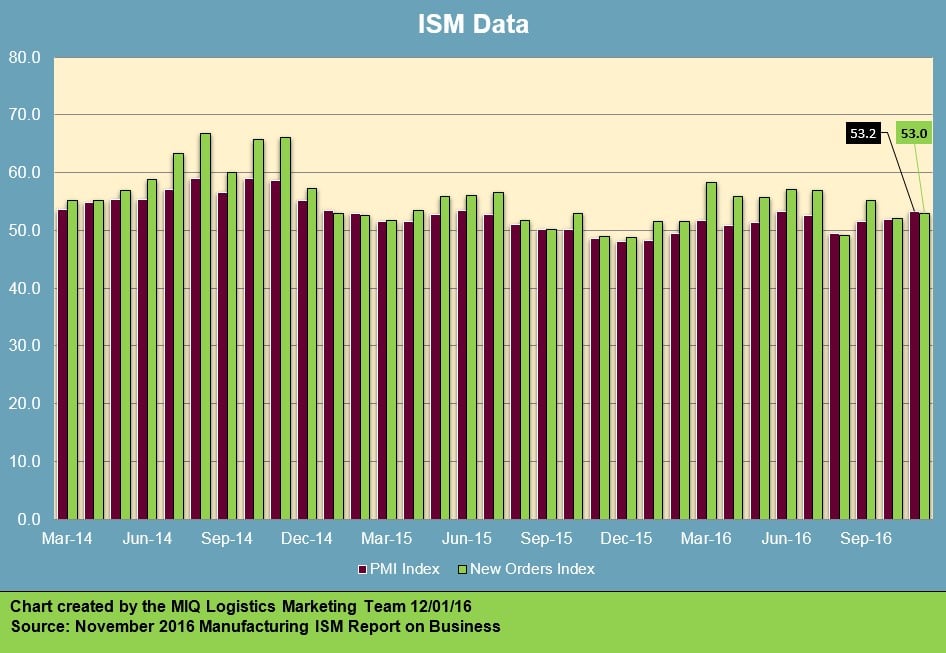

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. “The November PMI® registered 53.2 percent, an increase of 1.3 percentage points from the October reading of 51.9 percent. The New Orders Index registered 53 percent, an increase of 0.9 percentage point from the October reading of 52.1 percent. The Production Index registered 56 percent, 1.4 percentage points higher than the October reading of 54.6 percent. The Employment Index registered 52.3 percent, a decrease of 0.6 percentage point from the October reading of 52.9 percent. Inventories of raw materials registered 49 percent, an increase of 1.5 percentage points from the October reading of 47.5 percent. The Prices Index registered 54.5 percent in November, the same reading as in October, indicating higher raw materials prices for the ninth consecutive month. Comments from the panel cite increasing demand, some tightness in the labor market and plans to reduce inventory by the end of the year.”

Of the 18 manufacturing industries, 11 are reporting growth in November in the following order: Miscellaneous Manufacturing; Petroleum & Coal Products; Paper Products; Computer & Electronic Products; Food, Beverage & Tobacco Products; Chemical Products; Fabricated Metal Products; Plastics & Rubber Products; Machinery; Nonmetallic Mineral Products; and Primary Metals. The six industries reporting contraction in November — listed in order — are: Printing & Related Support Activities; Wood Products; Apparel, Leather & Allied Products; Electrical Equipment, Appliances & Components; Transportation Equipment; and Furniture & Related Products.

WHAT RESPONDENTS ARE SAYING …

- “Raw materials have been rather flat. Ramping up for year-end and reducing inventory is main supply chain goal at this time.” (Chemical Products)

- “Strong manufacturing numbers in anticipation of strong year-end bookings.” (Computer & Electronic Products)

- “Business is still steady. We are foregoing our shutdown over Christmas break due to an increase in customer orders.” (Plastics & Rubber Products)

- “Heading into 2017, our business levels look pretty consistent compared to 2016.” (Primary Metals)

- “Sector remains strong, orders and forecasts are consistent and demand outlook is positive.” (Food, Beverage & Tobacco Products)

- “New spec buildings going up in our area. Local companies adding additional production space which equates to higher employment.” (Machinery)

- “Business conditions are good. Labor market is tightening such that it is difficult to staff to completely fulfill production demand.” (Miscellaneous Manufacturing)

- “We are seeing an upswing in customer Requests for Quotations this month; this is a positive sign for our business.” (Textile Mills)

- “Continued strong seasonal demand for product.” (Nonmetallic Mineral Products)

- “2017 is looking to be a very busy year.” (Fabricated Metal Products)

>> Click here to read the entire report from the Institute for Supply Management.