Source: Institute for Supply Management – December 2, 2019 Release

Economic activity in the manufacturing sector contracted in November, and the overall economy grew for the 127th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

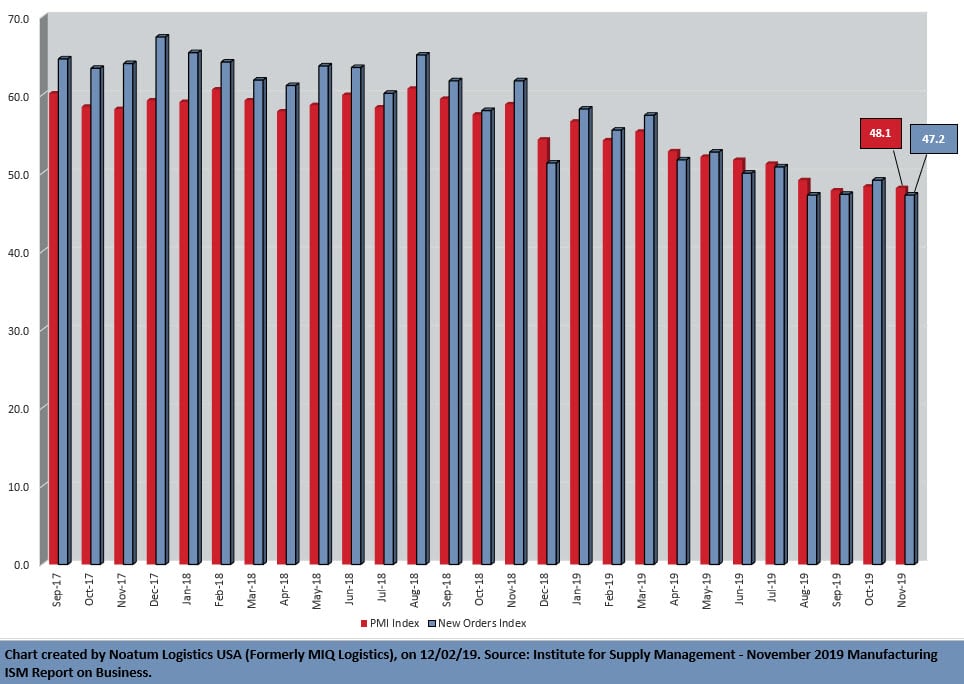

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The November PMI® registered 48.1 percent, a decrease of 0.2 percentage point from the October reading of 48.3 percent. The New Orders Index registered 47.2 percent, a decrease of 1.9 percentage points from the October reading of 49.1 percent. The Production Index registered 49.1 percent, up 2.9 percentage points compared to the October reading of 46.2 percent. The Backlog of Orders Index registered 43 percent, down 1.1 percentage points compared to the October reading of 44.1 percent. The Employment Index registered 46.6 percent, a 1.1-percentage point decrease from the October reading of 47.7 percent. The Supplier Deliveries Index registered 52 percent, a 2.5-percentage point increase from the October reading of 49.5 percent. The Inventories Index registered 45.5 percent, a decrease of 3.4 percentage points from the October reading of 48.9 percent. The Prices Index registered 46.7 percent, a 1.2-percentage point increase from the October reading of 45.5 percent. The New Export Orders Index registered 47.9 percent, a 2.5-percentage point decrease from the October reading of 50.4 percent. The Imports Index registered 48.3 percent, a 3-percentage point increase from the October reading of 45.3 percent.

“Comments from the panel were consistent with the previous month, with sentiment improving compared to October. November was the fourth consecutive month of PMI® contraction, at a faster rate compared to the prior month. Demand contracted, with the New Orders Index contracting faster, the Customers’ Inventories Index remaining at ‘too low’ levels and the Backlog of Orders Index contracting for the seventh straight month (and at a faster rate). The New Export Orders Index returned to contraction territory, likely contributing to the faster contraction of the New Orders Index. Consumption (measured by the Production and Employment indexes) contracted, due primarily to lack of demand, but contributed positively (a combined 1.8-percentage point increase) to the PMI® calculation. Inputs — expressed as supplier deliveries, inventories and imports — were again lower in November, due primarily to contraction in inventories that was partially offset by supplier deliveries returning to ‘slowing.’ This resulted in a combined 0.9-percentage point decrease in the Supplier Deliveries and Inventories indexes. Imports contraction softened. Overall, inputs indicate (1) supply chains are meeting demand and (2) companies are less confident that materials received will be consumed in a reasonable time period. Prices decreased for the sixth consecutive month, at a slower rate.”

“Global trade remains the most significant cross-industry issue. Among the six big industry sectors, Food, Beverage & Tobacco Products remains the strongest, while Fabricated Metal Products is the weakest. Overall, sentiment this month is neutral regarding near-term growth,” says Fiore.

Of the 18 manufacturing industries, five reported growth in November: Apparel, Leather & Allied Products; Food, Beverage & Tobacco Products; Paper Products; Miscellaneous Manufacturing; and Computer & Electronic Products. The 13 industries reporting contraction in November — listed in order — are: Wood Products; Printing & Related Support Activities; Furniture & Related Products; Textile Mills; Fabricated Metal Products; Transportation Equipment; Primary Metals; Plastics & Rubber Products; Petroleum & Coal Products; Nonmetallic Mineral Products; Machinery; Chemical Products; and Electrical Equipment, Appliances & Components.

Click here to access the entire release from the Institute for Supply Management website.