Institute for Supply Management

Economic activity in the manufacturing sector expanded in October, and the overall economy grew for the 89th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

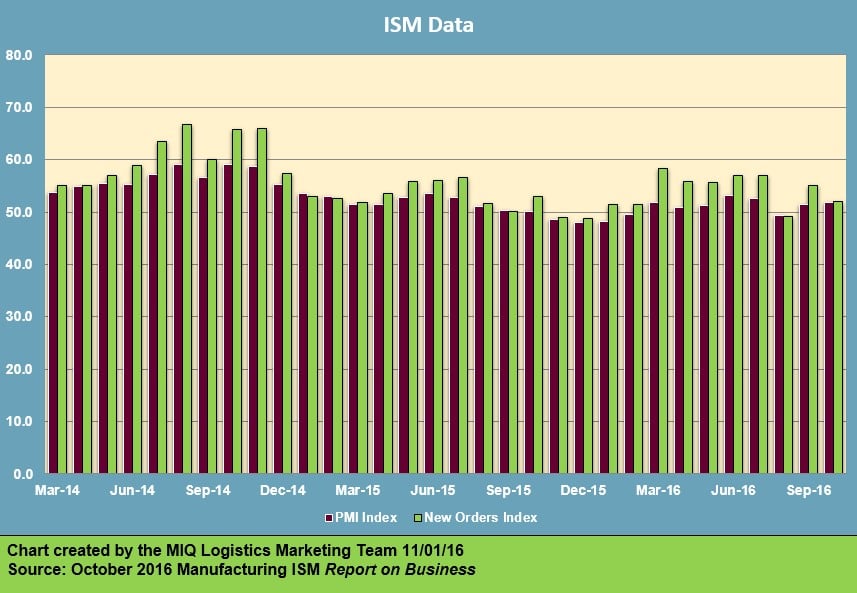

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. “The October PMI® registered 51.9 percent, an increase of 0.4 percentage point from the September reading of 51.5 percent. The New Orders Index registered 52.1 percent, a decrease of 3 percentage points from the September reading of 55.1 percent. The Production Index registered 54.6 percent, 1.8 percentage points higher than the September reading of 52.8 percent. The Employment Index registered 52.9 percent, an increase of 3.2 percentage points from the September reading of 49.7 percent. Inventories of raw materials registered 47.5 percent, a decrease of 2 percentage points from the September reading of 49.5 percent. The Prices Index registered 54.5 percent in October, an increase of 1.5 percentage points from the September reading of 53 percent, indicating higher raw materials prices for the eighth consecutive month.

Comments from the panel are largely positive citing a favorable economy and steady sales, with some exceptions.”

SPECIAL QUESTION

For inclusion in this report, our panel responded to a special question regarding the Hanjin Shipping Company bankruptcy to gain insights into the impact on their businesses this quarter. The responses were as follows:

Not impacted — 51.9%

Small, not material impact — 29.7%

Material, but manageable impact — 13.4%

Large material impact — 0.8%

Unsure — 4.2%

Of the 18 manufacturing industries, 10 are reporting growth in October in the following order: Textile Mills; Miscellaneous Manufacturing; Food, Beverage & Tobacco Products; Nonmetallic Mineral Products; Computer & Electronic Products; Furniture & Related Products; Paper Products; Printing & Related Support Activities; Petroleum & Coal Products; and Chemical Products. The eight industries reporting contraction in October — listed in order — are: Wood Products; Apparel, Leather & Allied Products; Primary Metals; Plastics & Rubber Products; Transportation Equipment; Electrical Equipment, Appliances & Components; Fabricated Metal Products; and Machinery.

WHAT RESPONDENTS ARE SAYING …

“Domestic business steady. Export business trending higher.” (Chemical Products)

“Very favorable outlook in the market.” (Computer & Electronic Products)

“We are looking at a considerable slowdown for October and November. Production is down 20 percent.” (Primary Metals)

“Business is much better.” (Fabricated Metal Products)

“Strong economy driving steady sales.” (Food, Beverage & Tobacco Products)

“Due to the hurricane and other storms, our business is up significantly.” (Machinery)

“Ongoing strength seen in 2016 — it’s a good year.” (Miscellaneous Manufacturing)

“Customers continue to press price reductions.” (Transportation Equipment)

“Our business remains strong.” (Plastics & Rubber Products)

“Hard to predict oil price dynamics, but there seems to be a consensus that the market is stabilizing, at least above USD 50 bbl this month.” (Petroleum & Coal Products)

>> Click here to access the entire report from the Institute for Supply Management.