Source: National Retail Federation Press Release- April 7, 2022

WASHINGTON – The nation’s major retail container ports have begun to catch up with the backlog of cargo seen over the past several months, but could experience another surge this summer, according to the monthly Global Port Tracker report released today by the National Retail Federation and Hackett Associates.

“As we entered 2022, the biggest question was when the supply chain would return to normal,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “Unfortunately, we still don’t have a definitive answer. Congestion at West Coast ports has eased, but congestion at some East Coast ports is growing. Ports aren’t as overwhelmed as they were a year ago, but they are still significantly busy moving near-record volumes of cargo.”

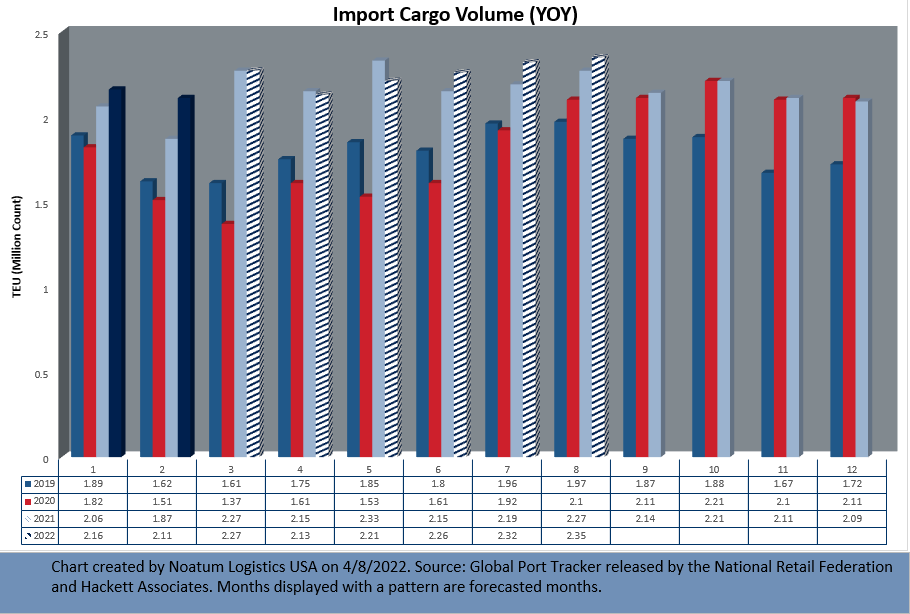

U.S. ports covered by Global Port Tracker handled 2.11 million Twenty-Foot Equivalent Units – one 20-foot container or its equivalent – in February, the latest month for which final numbers are available. That was down 2.3 percent from January but up 13 percent year-over-year.

Hackett Associates Founder Ben Hackett said volumes remained high in February despite factories in parts of Asia closing for the Lunar New Year holiday because U.S. ports were able to handle cargo from ships already waiting for a berth.

“With West Coast ports still congested, there were still plenty of containers to be unloaded,” Hackett said. Similarly, the current near-shutdown of Shanghai because of COVID-19 precautions means fewer ships are leaving China and “the wait on that side of the Pacific will help reduce the pressure of vessel arrivals at Los Angeles-area terminals.” An influx of vessel arrivals following the resumption of normal operations in China could result in renewed congestion at U.S. ports, however.

Ports have not yet reported March numbers, but Global Port Tracker projected the month at 2.27 million TEU, unchanged from the same month last year. April is forecast at 2.13 million TEU, down 1.1 percent from last year, and May at 2.21 million TEU, down 5.3 percent year-over-year. Increases are expected to resume in June, which is forecast at 2.26 million TEU, up 5.2 percent year-over-year. July is forecast at 2.32 million TEU, up 5.6 percent, and August at 2.35 million TEU, a 3.3 percent year-over-year increase that would set a new record for the number of containers imported in a single month since NRF began tracking imports in 2002. The current record is 2.33 million TEU in May 2021.

The first six months of 2022 are expected to total 13.1 million TEU, up 2.5 percent year-over-year. Imports for all of 2021 totaled 25.8 million TEU, a 17.4 percent increase over 2020’s previous annual record of 22 million TEU.

Click here to access the National Retail Federation website for the entire press release.