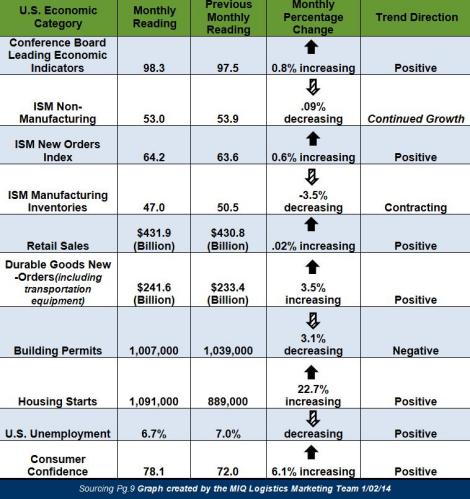

“The LEI continues on a broad-based upward trend, suggesting gradually strengthening economic conditions through early 2014,” said Ataman Ozyildirim, Economist at The Conference Board. “Improving labor markets and new orders in manufacturing, combined with strong financial indicators, drove November’s gain. However, consumers’ outlook for the economy and the drop in housing permits continue to pose risks in 2014.”

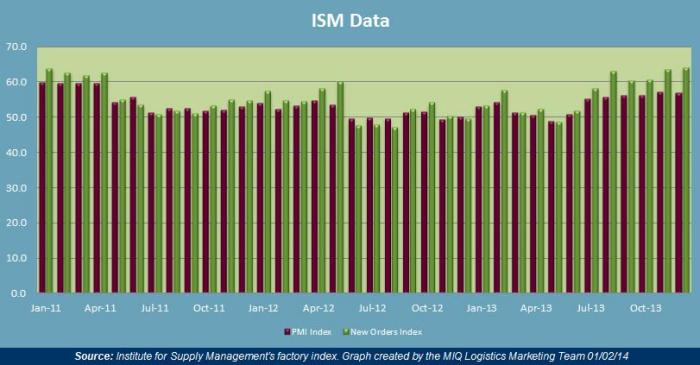

Institute for Supply Management (ISM) Manufacturing Report on Business

Economic activity in the manufacturing sector continued to expand in December

- 50 represents the dividing line between expansion and contraction for the index of the below chart; which covers the Purchasing Managers Index (PMI) and new orders.

- The PMI registered 57.0% in December, which was the second highest reading in 2013; the previous highest reading occured in November, when the PMI was 57.3%.

- New Orders increased in December by 0.6%; which raised the reading to 64.2%.

Expanding Manufacturing Industries

- Furniture & Related Products

- Plastics & Rubber Products

- Textile Mills

- Apparel, Leather & Allied Products

- Computer & Electronic Products

- Paper Products

- Transportation Equipment

- Primary Metals

- Fabricated Metal Products

- Wood Products

- Printing & Related Support Activities

- Food, Beverage & Tobacco Products

- Miscellaneous Manufacturing

Contracting Manufacturing Industries

- Nonmetallic Mineral Products

- Machinery

- Chemical Products

- Electrical Equipment, Appliances & Components

Transportation Market Update

| Truckload Index Category | Monthly Reading | Previous Monthly Reading | Trend Direction |

| American Trucking Associations (SA) seasonally adjusted For-Hire Truck Tonnage | 128.5 | 125.1 | + 2.7% Increasing |

| Cass Freight Index Report Shipments | 1.037 | 1.105 | – 0.7% Decreasing |

| Cass Freight Index Report Expenditures | 2.387 | 2.524 | – 5.4% Decreasing |

| Freight Transportation Services Index (TSI) | 116.5 | 114.3 | + 1.2 Increasing |

| Trucking Employment | + 100 Jobs | + 8400 Jobs | Positive |

| NAFTA Statistics for August | 59.5% of the $103.1 Billion of U.S. – NAFTA trade was transported by truck in October; this is up 3.1% YOY | ||

“Tonnage snapped back in November, which fits with several other economic indicators,” said ATA Chief Economist Bob Costello. “Assuming that December isn’t weak, tonnage growth this year will be more than twice the gain in 2012.” “Still, truck tonnage continues to be supported by fast growing sectors of the economy that generate heavy freight loads, like residential construction, fracking for oil and natural gas, and auto production,” Costello said.

GLOBAL MARKET UPDATE

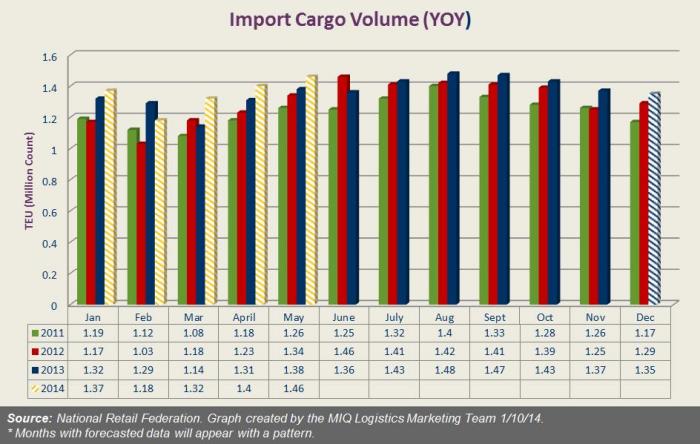

Recent Updates from National Retail Federation and Hackett Associates

- U.S. ports followed by Global Port Tracker handled 1.37 million TEUs in November, which was up 6.5% YOY from November 2012.

- While December’s imported final TEU numbers are not visible yet; they were originally estimated at 1.35 million TEU which would be up 5% YOY for 2012. If 1.35 million holds accurate, then 2013 will have come in at 16.3 million TEUs imported for the entire year.

- “The new year looks to be stronger than the outgoing one, with better-than-expected GDP figures, lower unemployment rates and continued low inflation,” Hackett Associates Founder Ben Hackett said.

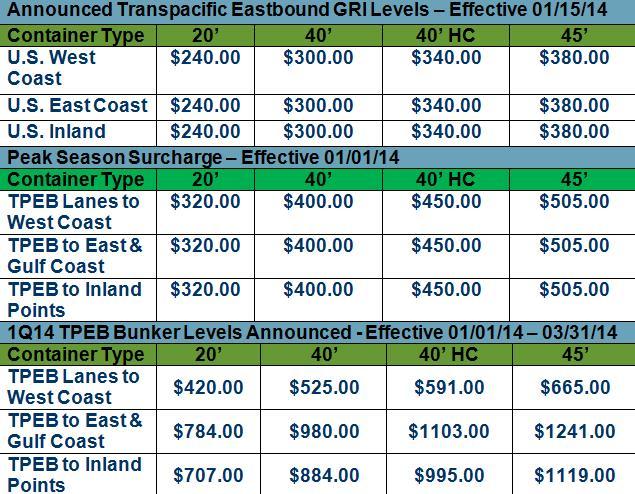

Transpacific Eastbound

*Note: The ocean carriers have announced their next round of GRI’s and some carriers have implemented a PSS (Peak Season Surcharge). Below are the PSS levels that were announced but the carriers have mitigates these levels.

2014: Chinese New Year Begins January 31st.

The industry is experiencing an artificial peak on U.S. import cargo volumes prior to the Chinese New Year, which is what is driving the above GRI and PSS level announcements.

SOURCES

Domestic & Global Economy

- “The Conference Board Leading Economic Index (LEI) for the U.S. Increased in November”– www.conference-board.org 12/19/13

- “December 2013 Manufacturing ISM Report on Business”– www.ism.ws 01/02/14

- “December 2013 Non-Manufacturing ISM Report on Business”– www.ism.ws 01/06/14

- “Employment Situation Summary”–www.bls.gov 01/10/14

- “Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders November 2013”– www.census.gov 12/24/13

- “New Residential Construction in November 2013”– www.census.gov 12/18/13

- “Consumer Confidence in U.S. Increases More Than Forecast”– www.bloomberg.com 12/31/13

- “Advance Monthly Sales for Retail and Food Services November 2013”– www.census.gov 12/12/13

Truckload Capacity & Volumes

- “Cass Freight Index Report”– www.cassinfo.com – Dec 2013

- “Bureau of Transportation Statistics reports Freight TSI hits an all-time high in November”– www.logisticsmgmt.com 01/09/14

- “ATA Truck Tonnage Index Jumped 2.7% in November”– www.truckline.com 12/20/13

- “U.S. –NAFTA trade hits record levels in October, reports BTS”– www.logisticsmgmt.com 01/07/14

Global Market Update

- “Retail Imports Expected To Be Up 4.8 Percent In January” – www.nrf.com 01/10/14